Tracing the Overrated Standards of International Banks (IFC, EBRD)

When the boycott of Ameriabank started because of the contract signed between the bank and Lydian Armenia for providing the latter with a loan of 24 million USD to purchase equipment for construction of the gold mine and heap leach facility, the employees of the bank started a self-defense. They argued that World Bank’s (WB) private-lending arm International Finance Corporation (IFC) and European Bank for Reconstruction and Development (EBRD) do not distribute loans to everyone, and if this project received the support of these institutions, then it is a trustworthy project. They insisted on this on the Facebook rating page of the bank (as the rating of the bank was going down), as well as during individual meetings with some of the dissatisfied customers.

And while the indignation of the employee caused by the drop of the reputation of his/her workplace is clear, it is unclear why some people are still unaware of the opportunities provided by Google and are readily protecting any investment project in Armenia without questioning the project or doing any sort of research or analysis.

We are able to use opportunities provided by Google and thus research as to how justified the trust of Ameriabank’s employees and Armenia’s government is towards WB’s, IFC’s and EBRD’s standards.

Short introduction: World Bank is providing loans to governments, while its International Finance Corporation provides loans to the private sector (banks, companies, etc). WB, IFC as well as EBRD provide loans in case projects correspond to their standards that are aimed at not harming the local communities and environment. Now let’s see what the reality is.

IFC in Peru

Yanacocha gold mine in Peru photo by Jeffrey Burry

In April 2015 an article was published in Huffington Post about Yanacocha gold mine in Peru operating for 22 years, owned by American Newmont Mining corporation and receiving financial support from IFC. This project not only left the locals in poverty, but also contaminated drinking water resources. Despite the government receiving 2.75 billion USD since the start of the mine, in Cajamarca, where Yanacocha is based, 53 percent of the population live under the national poverty line of about $100 a month. This is the poorest province in Peru.

Additionally, scientists have found increased levels of harmful heavy metals in the soil and water near the mine. In Yanacocha cyanide-heap leaching has been used, as in many other gold mines. Streams that once ran clear had become clouded and foul-smelling. Peru’s Ministry of Fishing had recently reported that more than 21,000 trouts had been killed by acidic mine runoff into two rivers that flow near Yanacocha.

Later, a truck transporting mercury spilled the hazardous metal along the road to Cajamarca after a barrel holding the substance cracked. Locals’ animals either don’t drink these waters or drink, get sick and die. In 2014, food safety experts from the University of Barcelona found elevated levels of lead, cadmium and other heavy metals in the food and water in communities near Yanacocha. These metals are associated with higher rates of cancer and kidney failure, as well as cardiovascular diseases. The report suggested the locals not to drink from these streams. In December of the same year, officials from Peru’s environmental ministry issued a report indicating that tainted water had seeped out of the mine into the neighboring community of San Jose.

Speaking of gold extraction and methods used for this purpose, including cyanide heap-leaching, Keith Slack, a mining expert at Oxfam, says he doesn’t know of any examples where there wasn’t some contamination problem (source).

Meanwhile, IFC continues financing this project. First it allocated 23 million USD in the project, got 5 percent ownership stake in the mine, later financed the expansion of this mine. When locals opposed the expansion, the police pressured the protests and killed five people. IFC in response announces, that mining provides best path out of poverty (more on this here).

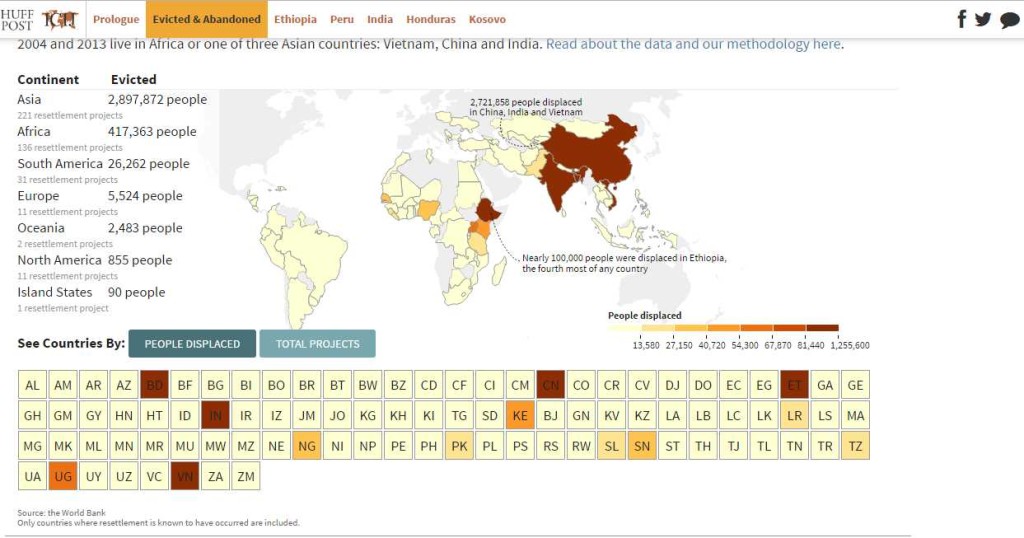

From 2009 to 2013, IFC and World Bank invested 50 billion USD in 239 high-risk category projects, including dams, copper mines and oil pipelines. Much of these development projects were in countries, where governments are weak and regulations are lax. According to research, 455 billion USD was invested between 2004 and 2013 in projects that led to 3.4 million people losing their homes, being deprived of their land or had their livelihoods damaged by power plants, mines and other projects backed by the bank. Some were compensated, others received nothing or were even forcibly evicted. In many cases WB and IFC simply failed to apply their own standards (source).

Map of evicted people caused by WB projects photo by Huffington Post

IFC in India

In April 2015, local fishing communities and farmers represented by EarthRights International sued IFC in federal court in Washington, D.C. over the destruction of their livelihoods, loss and damage to their property, and the threats to their health caused by the IFC-funded coal-fired power plant Tata Mundra in Gujarat, India. This is the first time a community harmed by a World Bank Group project has filed a lawsuit in a United States court.

The plant takes in enormous quantities of seawater to use for cooling purposes, then discharges the hot wastewater back into the sea. This has already substantially changed the local marine ecosystem and led to a drastic decline in the fish local fishing communities depend upon. Moreover, construction of the plant’s massive outfall and intake channels has also resulted in both physical and economic displacement of local fishing communities, and has contributed to saltwater intrusion into the groundwater, destroying vital sources of drinking water and water used for irrigation in an area where fresh water is scarce. Meanwhile, IFC provided 450 million USD loan for this project (source).

Tata Mundra plant in India photo by corpwatch

In 2013 the IFC’s own accountability mechanism has sharply criticized the IFC for its role in the project. Following a complaint by the locals, the Compliance Advisor Ombudsman (CAO) concluded that the IFC had failed to ensure the project met the applicable Environmental and Social Standards necessary for IFC projects. It found that despite predicting the type of harm the project could cause, the IFC failed to take necessary steps to protect local communities and the environment (for more, check this and this).

IFC’s Direct and Indirect Involvement in Disasters

In 2016 it became clear that IFC indirectly, i.e. through commercial banks, finances some of the corporations in India which in the past years became known for their projects abusing human rights and polluting the environment. According to a report by Inclusive Development International (IDI), which follows the flow of IFC loans, between 2005 and 2014, the IFC invested $520 million in six Indian banks which in their turn invested these money in 12 of India’s most socially irresponsible corporations, including -NHPC Limited, which owns dams that have submerged the homes, forests and farmland of hundreds of thousands of people without restitution and damaged crucial waterways, -Vedanta Resources, which attempted to displace and carve up the sacred land and forests of the Dongria Kondh tribe, -Eveready Industries, formerly known as Union Carbide India, which was responsible for the Bhopal gas disaster, the worst industrial accident in history, -Zuari Agri Sciences, a cottonseed company that has been implicated in the worst forms of child labor, -Adani Power, whose Mundra coal plant, port and special economic zone has polluted the coast of Gujarat, destroyed mangroves and displaced local fishing families.

Overall, IDI uncovered 68 Indian companies or projects implicated in serious harmful environmental impacts or abusive human rights practices that received funding from IFC intermediaries (more in here).

IDI also followed where IFC’s 50 billion USD went in 2010-2015 and found out that these were provided to such intermediary banks and other financial institutions, which then invested those in some notorious companies and projects in the world. The latter have led to forced evictions, forest logging, pollution of the oceans and rivers, while activists who had resisted them were jailed, beaten and even murdered. IDI prepared a list of IFC funded similar projects through intermediaries that can be found here (source).

Nam Theun 2 dam in Laos photo by topicstock.pantip.com

As to WB sponsored projects, a 2012 internal review of nine World Bank-supported projects found that the number of affected people turned out to be, on average, 32 percent higher than the figure reported by the bank before approving the initiatives. Thus understating the number of people affected by the nine projects by 77,500. This echoed a broader internal review in 1994, which looked at 192 projects and found that the real number of affected people averaged 47 percent higher than previously estimated (more on this here).

For example, WB financed Nam Theun 2 dam in Laos has physically displaced or economically affected more than 75,000 villagers. This is a 50 percent increase over the 50,000 figure that the bank had reported before it approved the project in 2005. Independent researchers who have studied the project estimate that the number of people who have been harmed by the dam’s construction is larger than even bank’s updated number — reaching as high as 130,000 to 150,000. And this is in a situation when almost all of the power has been exported to Thailand, despite one in four Laotians not having access to electricity (more on this here and here).

WB in Kosovo

The lignite mining project in Kosovo’s Hade region is a good example to see how WB, prior to approving its loan for a project, pushes for creation of laws that will in the future spare it from liability.

Lignite mine in Hade, Kosovo photo by Karl Mathiesen

In 2004 WB started to consult Kosovo’s provisional government in terms of resettlement issues. In 2006, the bank approved an $8.5 million technical assistance grant to Kosovo’s government to deal with issues relating to coal mining, studying whether to build a new coal-powered plant, as well as for advising the government on future resettlements. The bank even provided its experts for policy advice in handling relocations of large numbers of people. Nearly 700 people, around 150 families, were forced out of the affected region of Hade in 2004 and 2005. The bank also helped Kosovo’s legislature craft a new law on how to handle evictions for public projects.

Interestingly, the new law did not require that the government restore the level of living conditions of displaced people to those that are equal to what they had before they were forced to move.

In 2012, residents of Hade and nearby villages filed a complaint with the World Bank’s Inspection Panel. However, they were told that since the bank has not yet made a final decision regarding the final approval for the proposed $58 million loan, the locals have no right to complain to the Inspection Panel. Meanwhile, as Kosovo’s government continued evictions targeting Hade’s neighborhoods, the residents had to move to a new location, where apart from roads and a few new buildings, there is nothing else – no school, mosque, medical clinic or stores (more in here).

For more on projects financed by WB and IFC, click here.

Now about EBRD financed projects

The NGO Bankwatch monitors the funds of international financial institutions. It has collected data on projects financed by EBRD during the past 20 years that negatively impacted communities and nature. One of these projects is the above mentioned coal plant project in Kosovo’s Hade region that is opposed by locals because of reduction of agricultural lands, threat to water resources, eviction of locals and many other reasons. Still, EBRD expressed interest in making investments in this project. By the way the realization of this project is entrusted to American Contour Global company, which also owns Vorotan, a hydropower plant in Armenia (more regarding EBRD and coal plant in Kosovo here).

EBRD in Georgia

In neighboring Georgia EBRD provides loans to such hydropower projects that threaten to evict locals (particularly Svan communities). This is particularly concerning since Georgia’s legislation does not address the issue of involuntary resettlement caused by infrastructure projects. Additionally, EBRD doesn’t mind investing in Georgia, where Environmental Impact Assessment system is ineffective both in terms of providing the public with information and opportunities for public participation. In recent years many hydropower projects were irregularly constructed in the north of the country, even in protected natural areas, some of which also caused floods and landslides (more in here).

Protest in Georgia during a public hearing photo by Bankwatch

Generally, EBRD seems to have a particular interest in hydropower projects. In 2011, before Croatia’s acceptance to the EU family (meaning that the laws would become stricter), EBRD quickly approved its 123 million Euro loan for building hydropower plant on river Ombla near Dubrovnik. EBRD didn’t even consider the fact that the river is a protected EU’s Natura 2000 site and didn’t wait for an environmental impact assessment (more in here). However, thanks to public opposition, EBRD pulled out from financing the project in 2013 (more in here).

Recently, it became known that EBRD also sees no problem in funding hydropower projects even in national parks. It planned to allocate 65 million Euro for hydropower dam inside the Mavrovo National Park in Macedonia. However, thanks to opposition of environmentalists and the European wildlife treaty’s Standing Committee of the Bern Convention, EBRD withdrew from financing this project, while WB withdrew from financing another hydropower plant project in the same National Park (more in here).

EBRD in Kyrgyzstan

But EBRD is of course interested in mining too. However, mining projects financed by the bank may not necessarily correspond to the bank’s standards either.

Kumtor gold mine in Kyrgyzstan photo by Silk Road Reporters

Explosions in Kumtor mine in Kyrgyzstan negatively affect some of the most important glaciers in Central Asia, which are an important water supply for the region. The company that operates the mine, Centerra Gold announced, however, that Kumtor mine’s effect on the conditions of glaciers in the Kumtor area is minimal and cannot be compared to the climate change processes. Still environmentalists highlight, that in the past these glaciers have had 700 million cubic meters of ice mass, but now, only 200 million cubic meters are left. They mention that the destruction of glaciers has created massive waste mixed with ice, acids and heavy metals which estimated at 2 billion tons. Melting masses can end up in Lake Issyk-Kul and the Naryn River, threatening the ecosystem of the whole country.

Geologist and climatologist William Colgan from York University, who has been studying glaciers, says that while climate change is the main factor driving glacier retreat across the Tien Shan range, glaciers in near Kumtor mine area are impacted by the mine. He mentions that these glaciers are retreating not only because of melting, but also by the increased ice removal conducted for accessing ore located beneath the glaciers.

He also says that the perimeter of the Kumtor mine open ice pit has been excavated at greater than 30 meters per year between 1998 and 2013, while over the same period, nearby glaciers have retreated at closer to 10 meters per year. Local mining activities are clearly a larger factor in the recent wastage of these glaciers.

Threatened glaciers photo by Ryskeldi Satke

Also Kumtor mine operators are known for not sharing information with the public, especially geotechnical information. Moreover, the company threatens with international arbitration if changes are made to Water Code of Kyrgyzstan for restricting the company’s practice of moving ice.

Meanwhile EBRD is not planning to revisit its continuous support for this project despite the harms to environment and corruption scandals. It also did not reconsider its attitude following the crash of a mining truck carrying cyanide, as a result of which nearly two tonnes of the deadly chemical spilled into a nearby river that was a main source of drinking water for villages downstream. In the immediate aftermath of the cyanide spill, 2,600 villagers were treated and more than 1,000 admitted to hospital. Locals also complain of the dust from the mine causing health problems in the district. Additionally, many locals opposing this mine have been detained, still EBRD doesn’t seem to be concerned about this (more on this here, here and here).

The number of similar projects is big. However, by mentioning a few ones we aim at showing the main purpose of these financial institutions – financial benefits for themselves. Profits are particularly easy to pursue in developing countries which have little or no established justice systems, lack of democracy and absence of supervision. These projects also show the little effect which the standards created by international financial institutions, such as EBRD, IFC and WB, have in alleviating and/or preventing harm to people and the environment.

Armenian Environmental Front (AEF) civil initiative

Email: armecofront@gmail.com